Real-Time Payments have arrived. In real time…for real.

An engine for change and innovation in US payments.

RTP allows real-time payments from one account to another, utilizing new payment rails from The Clearing House. This payment method does away with many of the limitations of ACH and Wire payments. Payments are immediate, 24/7/365, not bound by bank cut-off times, or legacy processing windows. Transactions on the RTP network are real-time push payments which reduces the likelihood of fraud; payments are also irrevocable and are final once processed. RTP has the power to radically change the fabric of payments in the United States in the next decade.

Launched by The Clearing House in November 2017, Real-Time Payments (RTP) is currently accessible to financial institutions that hold 75% of U.S. demand deposit accounts (DDAs), and the network currently reaches 61% of U.S. DDAs. The RTP network is open to all federally insured U.S. depository institutions.[1] This is enormous, because it means that in a relatively short time period, over 75% of deposit accounts have the ability to accept RTP payments (subject to the functionality being enabled by their customer’s bank). It will not take many more years for the remaining banks to catch up, for fear of losing customers to banks that already support the payment method.

How RTP compares to other account-to-account payment methods

| Method | Currency | Urgency | Settlement speed | Reversal capabilities | Typical Usage |

| ACH | USD | Normal |

|

Reversal available within 5 business days. |

|

| Wire | Multiple | Urgent | Within a few hours | No payment reversal capabilities, beneficiary must approve the funds return in case of a return request. |

|

| RTP | USD | Urgent | Immediate | No payment reversal capabilities. |

|

Notable features of RTP include:

Irrevocability Payments cannot be returned (similar to wires). It is possible for a refund to be requested; however, this request can be denied by the customer or their bank; keeping them in control.

Speed RTP payments are processed 24 hours a day, 7 days a week, 365 days a year. ACH can be as fast as same day (a matter of hours), Wire can be even faster. However, both of these payment methods are restricted to bank processing days (i.e., if you urgently want to complete a time sensitive payment on a holiday, RTP would allow that to happen. Wire and ACH would be held up until the next working day).

Cost Although real-time payments are processed quicker than wires, the cost of RTP is significantly less than wires. This makes RTP a great alternative to process urgent payments.

RTP Use cases

Summary of value/volume processed in 2021 across ACH, Wire, and RTP in the US

| Calendar Year 2021 | ACH[2] | Wire[3] | RTP[4] |

| Volume of transactions (millions) | 29,100 | 204 | 123 |

| Value of transactions ($millions) | 72,600,000 | 991,810,545 | 54,000 |

| Average Transaction Value | $2,495 | $ 4,861,816 | $439 |

Once you get over the mindboggling scale of account-to-account payments in the US, you can begin to see how things could change in the future. Wires remain the vehicle of choice for fast, business critical payments of a high value. RTP has a $1m transaction limit which has the potential to cannibalize lower-value wires in the future. ACH is staggeringly engrained within the US. It’s how we get paid, and pay for services on a regular basis, but it’s slow. RTP offers many of the same benefits of ACH with the added benefit that it is immediate.

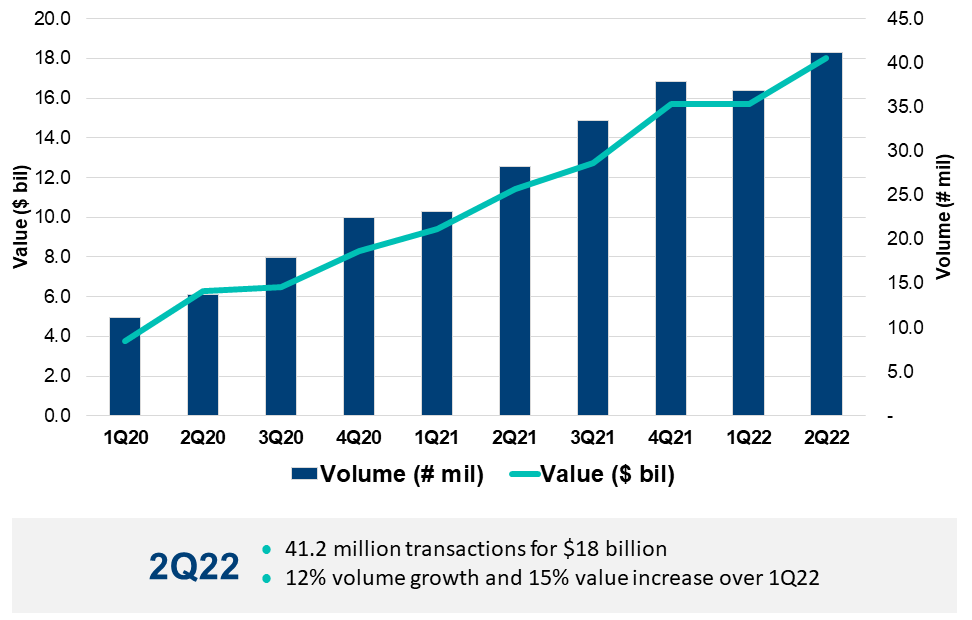

RTP Quarterly Payment Activity – The Clearing House[5]

The Clearing House’s RTP Quarterly Payment Activity tracker show a consistent regular increase in both adoption and volume, and there is no reason why that trend won’t continue. It will be exciting to see at what speed the volume and value will increase as this will likely result in the assimilation of what were historically the domain of ACH or Wire payments.

Instant payments 24/7/365 is now table stakes and offers a huge competitive advantage for our clients. The features of the RTP network provide payment finality and certainty, which reduces back-office reconciliation because transactions are now settled in real-time. This is especially true for key growth verticals like gaming and crypto where transactions need to be processed at any time regardless of banking hours. The addition of real-time payments gives end-users quicker access to their money[6]. – Maf Sonko, Head of Strategy and Operations at Victor.

If you would like to learn more about how Victor can support your business’ RTP, ACH, and Wire payment strategy please Contact Us.