FedNow on the Horizon

The decade in which real-time payments took hold in the US

In April ’23, The Federal Reserve announced its plans to launch its real-time bank-to-bank payment method, FedNow, in July of the same year. FedNow is similar to The Clearing House’s Real-Time Payments (RTP) payment method as each is aimed at facilitating faster, more efficient, and more secure payment options within the US. However, there are some notable differences between the two payment types:

Both FedNow and RTP are initiatives aimed at facilitating faster, more efficient, and more secure payment options in the United States.

Ownership & Governance

FedNow is a payment method created and regulated by the US Federal Reserve and is therefore an instrument owned by the US government. RTP is a payment method created by The Clearing House (TCH), which operates as a private sector entity. TCH is owned by a consortium of banks in the US, including JPMorgan Chase, Bank of America, and Wells Fargo, among others.

The Growth of Real-Time Payments

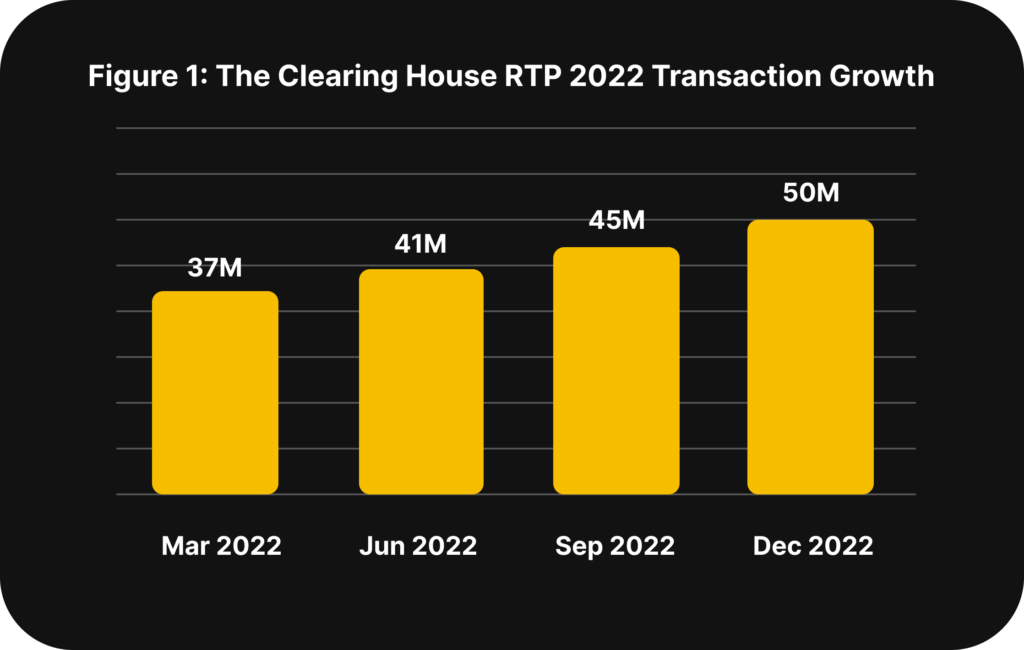

Since RTP was launched in November 2017, the number of financial institutions that support the payment method has been steadily increasing. In Q4 2022, TCH announced they had reached 285 financial institutions that support RTP. The number of processed transactions has also been steadily increasing, rising 4m+ per month in Q4 2022.

Figure 1. The Clearing House RTP 2022 Transaction Growth

Federal Reserve – The Federal Reserve announces July FedNow Service launch

The Clearing House – RTP Network Celebrates 5-Year Anniversary

FedNow is a late entrant to the real-time payments landscape. There are strong signals, however, that FedNow will quickly make progress obtaining a share of the real-time payments market when it launches in July. Any bank, regardless of their liquidity position with the Fed, is able to participate in FedNow, whereas TCH requires its members to open a settlement account with the Federal Reserve Bank of NY and maintain their liquidity position there to ensure all payments are covered. It’s

expected that larger banks will choose to adopt both payment methods in order maintain interoperability with those institutions that only select payment method.

Accessibility

FedNow is intended to be accessible to all depository institutions in the United States, including banks, credit unions, and other financial institutions. RTP is available to financial institutions that are members of TCH and have joined the RTP network; it is therefore not available to all financial institutions by default. A comprehensive list of all financial institutions participating in RTP may be found here.

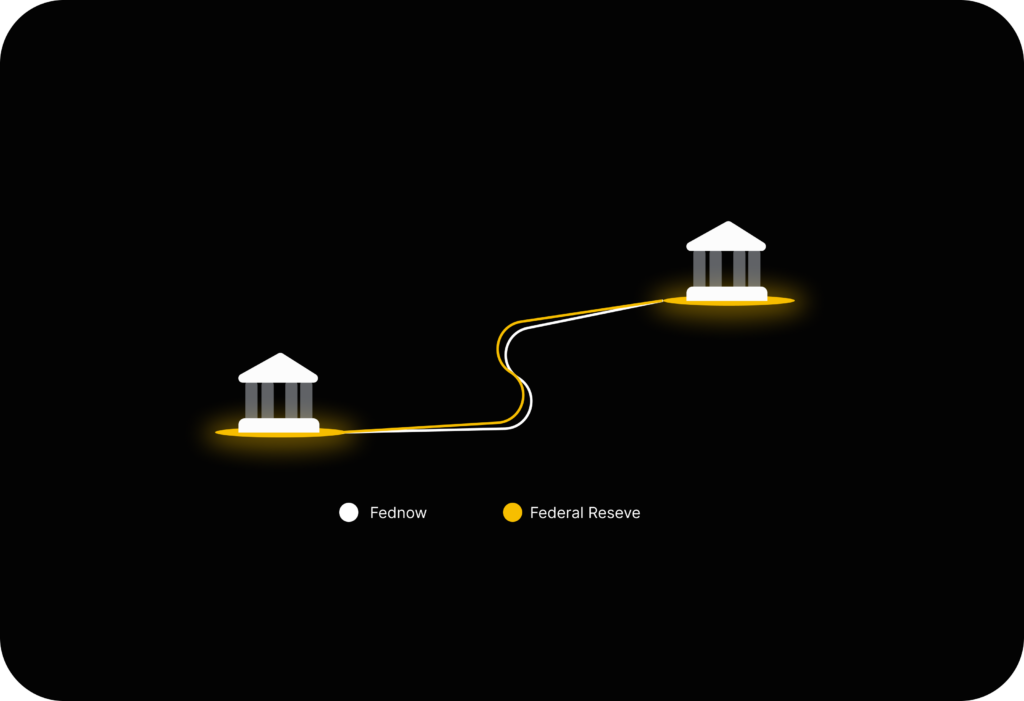

Settlement

FedNow utilizes the Federal Reserve’s settlement infrastructure, which means that transactions on the network settle directly at the Federal Reserve Banks. RTP, on the other hand, settles through TCH’s private network, with settlement occurring between participating financial institutions through the Federal Reserve Bank of NY. Banks would have to open an account with the Federal Reserve Bank of NY to fund their position as opposed to their current Federal Reserve bank.

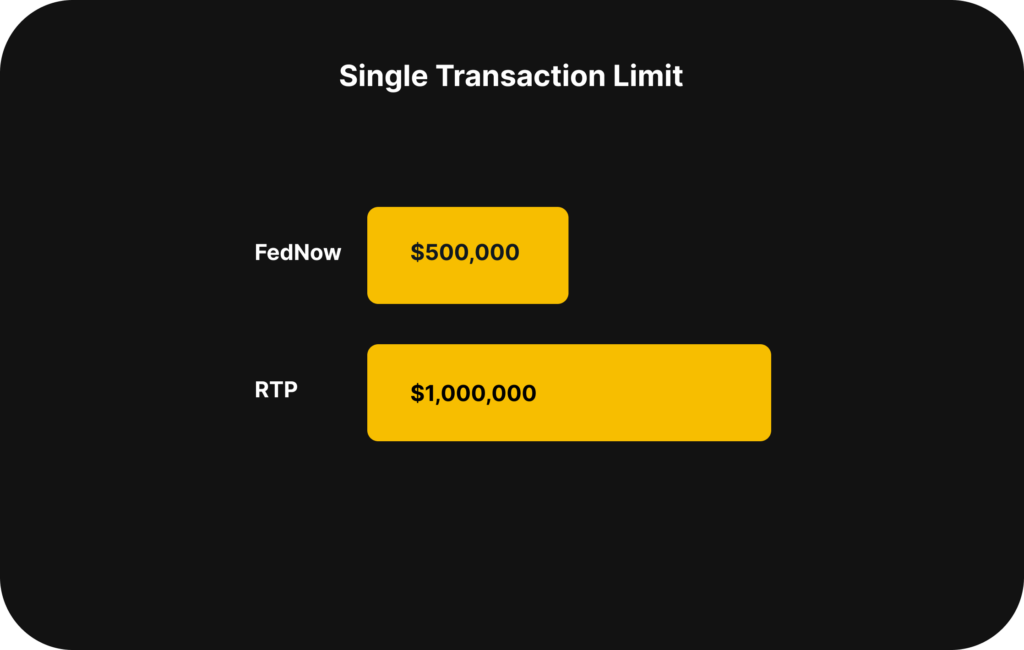

Transaction Limits

RTP’s upper transaction limit is currently $1,000,000. FedNow’s upper transaction limit will initially be set at $500,000 (although the default limit will be set at $100,000 and each financial institution may raise or lower this limit).

Figure 2. FedNow and RTP Payment Limits

Reserve Requirements

The ClearingHouse requires that each participating financial institution pre-fund their RTP position. This is typically a percentage of the expected daily volume of RTP transactions and acts as a safeguard for the integrity of the payment method. This reserve requirement puts a capital

Pricing approach and credit transfer limit for the Fed Now Service announced.

requirement on the bank. This is less of an issue for the larger US banks but may be more of a concern for smaller banks and credit unions. FedNow does not have the same mechanism as it operates in much the same way as Wire payments currently operate today.

Capabilities

| Capabilities | RTP | FedNow* |

| Send Payment | x | x |

| Receive Payment | x | x |

| Request for Payment | x | x |

| Request Refund | x | x |

*All outlined capabilities for FedNow are those which the Federal Reserve have stated will be available when FedNow launches in July ’23.

Use Cases

Faster payments have a myriad of use cases, some of which are listed below:

Ecommerce

Instant payments for goods and services to merchants will improve business cashflow. Typical funding delays of 1-3 business days for accepting card payments prior to faster payments is not uncommon. Faster payments are push-only, so chargebacks will be a thing of the past, further ensuring cashflow integrity.

E-Invoicing

Faster payments support the ability to send e-invoices requesting payment and leveraging RTP or FedNow as a payment method. Invoices may be paid instantly with the payer having the peace of mind that funds are going to the correct account, significantly reducing accidental payments or incorrect payment amounts.

P2P

Faster payments allows for funds to be sent instantly between personal accounts, eliminating the need to wait for days for funds to arrive via ACH or added risk for third-parties still transmitting the money via ACH and making the money available before it’s actually arrived in the account.

Gig Economy

On-demand or gig economy workers like Uber or DoorDash drivers can receive payment immediately for services that they’ve completed without delay as faster payments are able to be transmitted 24 hours a day, 7 days a week, and 365 days a year. Faster payments have eliminated the need to wait for your bank to open in the morning or after a holiday. Regardless of the day or the hour, faster payments are always “on”.

Conclusion

Faster payments adoption is increasing rapidly in the US. The additional entry of FedNow will no doubt accelerate the adoption of 24/7/365 payments from existing slower payment methods like ACH and wires. With the countless advantages of immediate real-time payments becoming more readily available to businesses and consumers, this decade will be a defining period in US payments.

If you would like to learn more about how Victor can support your business’ faster payment strategy, please Contact Us.