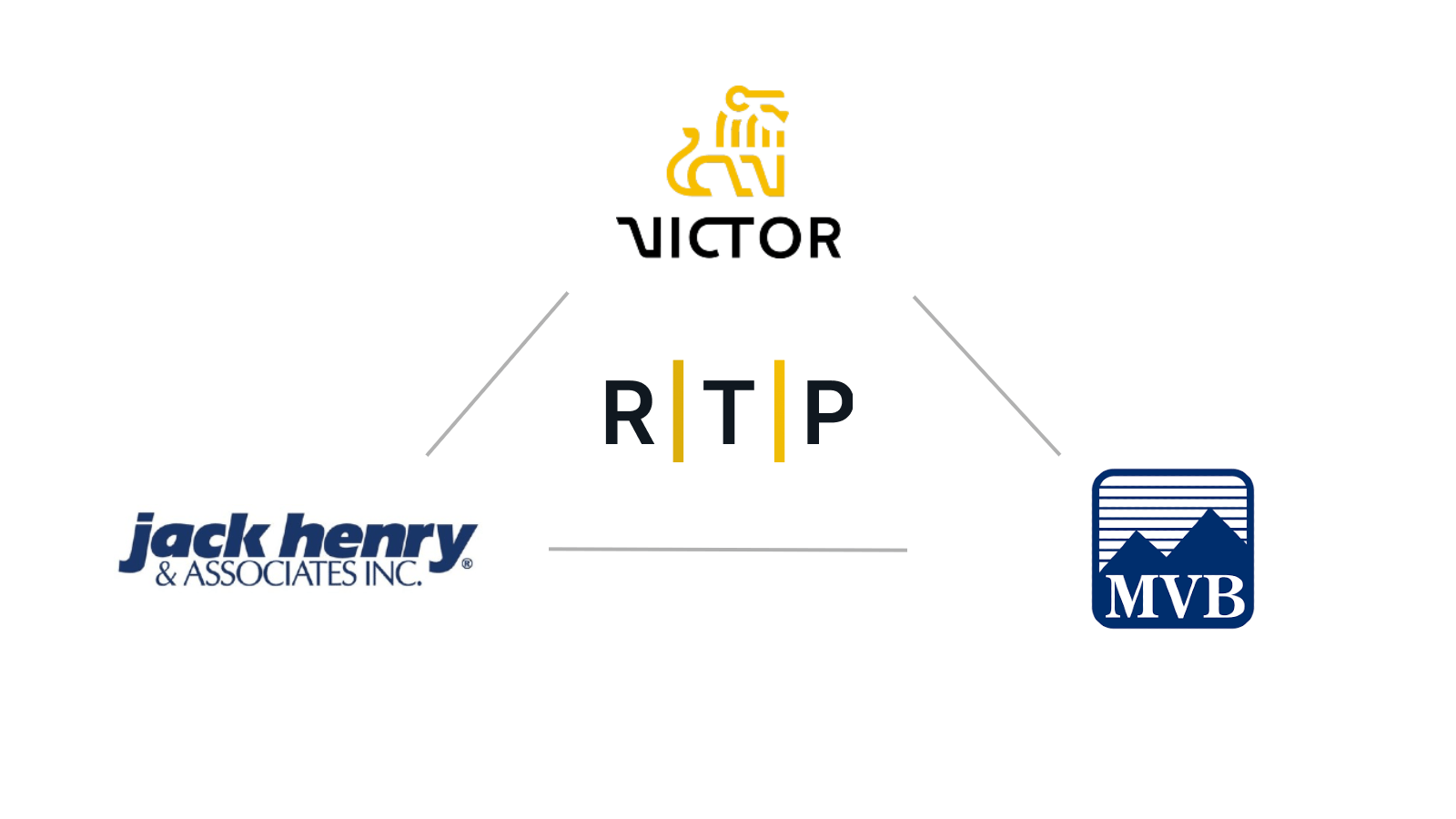

Jack Henry Collaborates with Victor Technologies and MVB Bank to Offer Faster Payments Capabilities

MONETT, Mo., July 27, 2022 /PRNewswire/ — Jack Henry & Associates, Inc.® (NASDAQ: JKHY) announced today that Victor Technologies, Inc. (“Victor”) is working with the company to advance its instant payments strategy.

A subsidiary of MVB Edge Ventures, Inc. (“MVB Edge Ventures”), and part of the MVB Bank, Inc. (“MVB Bank”) family, Victor helps banks manage fintech partnerships and compliance through its integrated risk management software as well as APIs for fintechs to embed financial services. Since May of 2021, the Victor team has built a virtual account ledgering solution with a suite of payment APIs to move money via ACH, Wires, Internal transfers, and now real-time payments over the RTP® network.

Victor recently added RTP capabilities to expand its services. JHA PayCenter™ is Jack Henry’s proprietary faster payments hub that provides seamless connections to the faster payments networks, enabling real-time payments to be sent and received through MVB Bank’s Jack Henry core. MVB Bank is the first client live using RTP Send functionality and plans to offer RTP Request for Payment. Both solutions will help Victor support the faster payments needs of consumers and businesses.

Jenifer Nadeem, director of enterprise applications at MVB Financial Corp., the holding company of MVB Bank, commented, “Our long-standing relationship with Jack Henry powers our day-to-day banking operations and opens the door for us to connect with innovative and emerging fintechs. Victor enables us to offer real-time payments capabilities which helps us expand into new business verticals and further solve the payment needs of our diverse clients.”

Maf Sonko, head of strategy and operations at Victor, added, “Instant payments 24/7/365 is now table stakes and offers a huge competitive advantage for our clients. The features of the RTP network provide payment finality and certainty, which reduces back-office reconciliation because transactions are now settled in real-time. This is especially true for key growth verticals like gaming and crypto where transactions need to be processed at any time regardless of banking hours. The addition of real-time payments gives end-users quicker access to their money.”

Tede Forman, vice president of payment solutions at Jack Henry, said, “Our work with both MVB Bank and Victor speaks to the openness and flexibility of Jack Henry’s Payments-as-a-Service Platform. Financial institutions can easily select and embed banking and payment capabilities. Our relationship with MVB Bank and Victor is the first of its kind and we encourage other clients to consider developing an instant payments strategy to meet the needs of consumers and businesses.”

About Victor Technologies, Inc.

Victor Technologies, Inc., (“Victor”) is a wholly owned subsidiary of MVB Edge Ventures, Inc., (“MVB Edge Ventures”) and a part of the MVB Bank, Inc. (“MVB Bank”) family (collectively “MVB”). MVB Financial Corp., (“MVB Financial”) the innovative financial holding company of MVB Bank, Inc., is publicly traded on The Nasdaq Capital Market® under the ticker “MVBF.” Victor provides banking technology solutions that simplify Bank-Fintech partnerships. Victor APIs help Fintech companies embed financial solutions within their apps and its Vantage tools help banks manage Fintech program risk and compliance at scale. For more information, visit www.victorfi.com.

About Jack Henry & Associates, Inc.

Jack Henry (NASDAQ: JKHY) is a leading SaaS provider primarily for the financial services industry. We are a S&P 500 company that serves approximately 8,000 clients nationwide and goes to market through three distinct brands: Jack Henry Banking® provides innovative solutions to community and regional banks; Symitar® provides industry-leading solutions to credit unions of all sizes; and ProfitStars® offers highly specialized solutions to financial institutions of every asset size, as well as diverse corporate entities outside of the financial services industry. With a heritage that has been dedicated to openness, partnership, and user centricity for more than 45 years, we are well-positioned as a driving market force in cloud-based digital solutions and payment processing services. We empower our clients and consumers with the human-centered, tech-forward, and insights-driven solutions that will get them where they want to go. Are you future ready? Additional information is available at https://www.jackhenry.com/pages/default.aspx.

SOURCE: https://www.prnewswire.com/news-releases/jack-henry-collaborates-with-victor-technologies-and-mvb-bank-to-offer-faster-payments-capabilities-301594129.html