New Client Portal Announcement

SEPTMEBER 2021 –

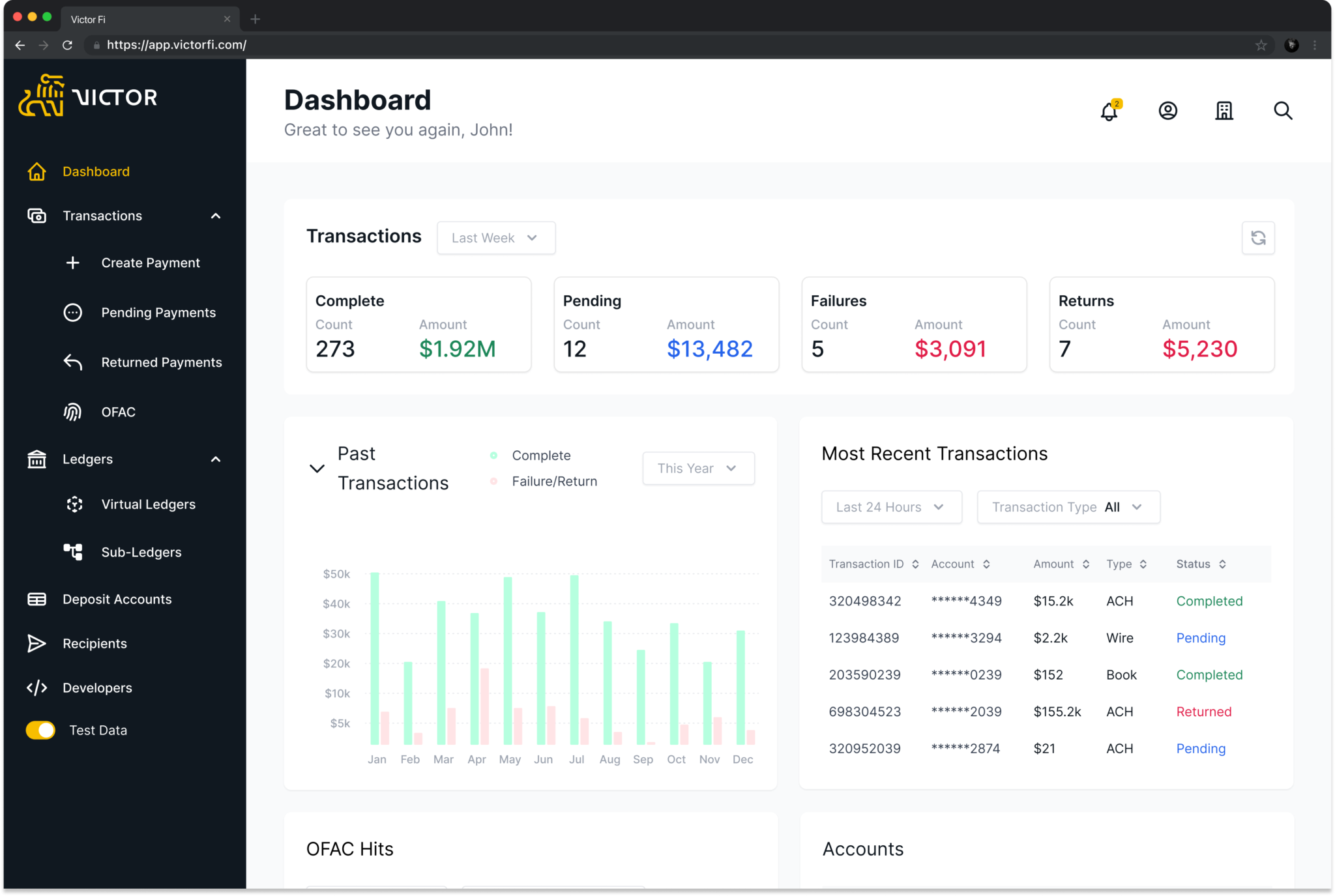

Victor is excited to announce the availability of the Victor Platform, a self-service portal to give FinTech companies access to the tools and data they need to manage their banking programs. Victor clients now have access to a complete program dashboard and detailed information about all their transaction history and banking activities.

NEW FEATURES

Insights

With enhanced Insights, businesses can view the operational data of their program at-a-glance from the Victor Platform. The Dashboard provides single panel views into different key business metrics, such as incoming and outgoing payment volumes, transaction volume by type, and the details of the most recent transactions, all updated in real-time so that as transactions occur the results are viewable in the Dashboard immediately. Whether interested in looking at the events of today, the current month, or just a specific transaction type, the Dashboard panels provide users the ability to interact with their data and gain program-wide insight on a single page.

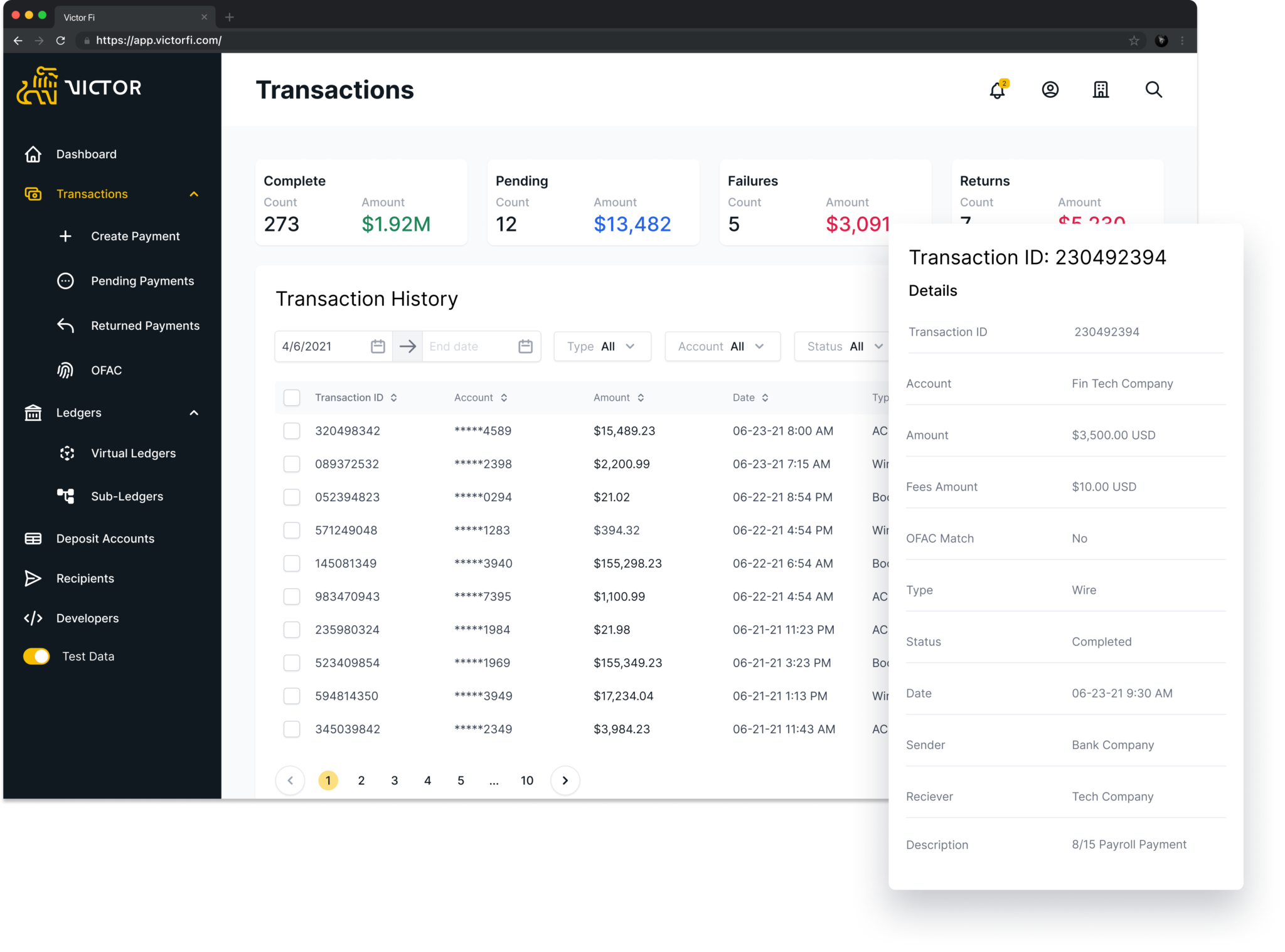

The upgraded Victor Platform also provides a complete view of the transaction history of all transactions created, completed, failed, and returned. Drill down into the details of any transaction to see the originating account, the recipient details, as well as the amount and any memo attached to the payment.

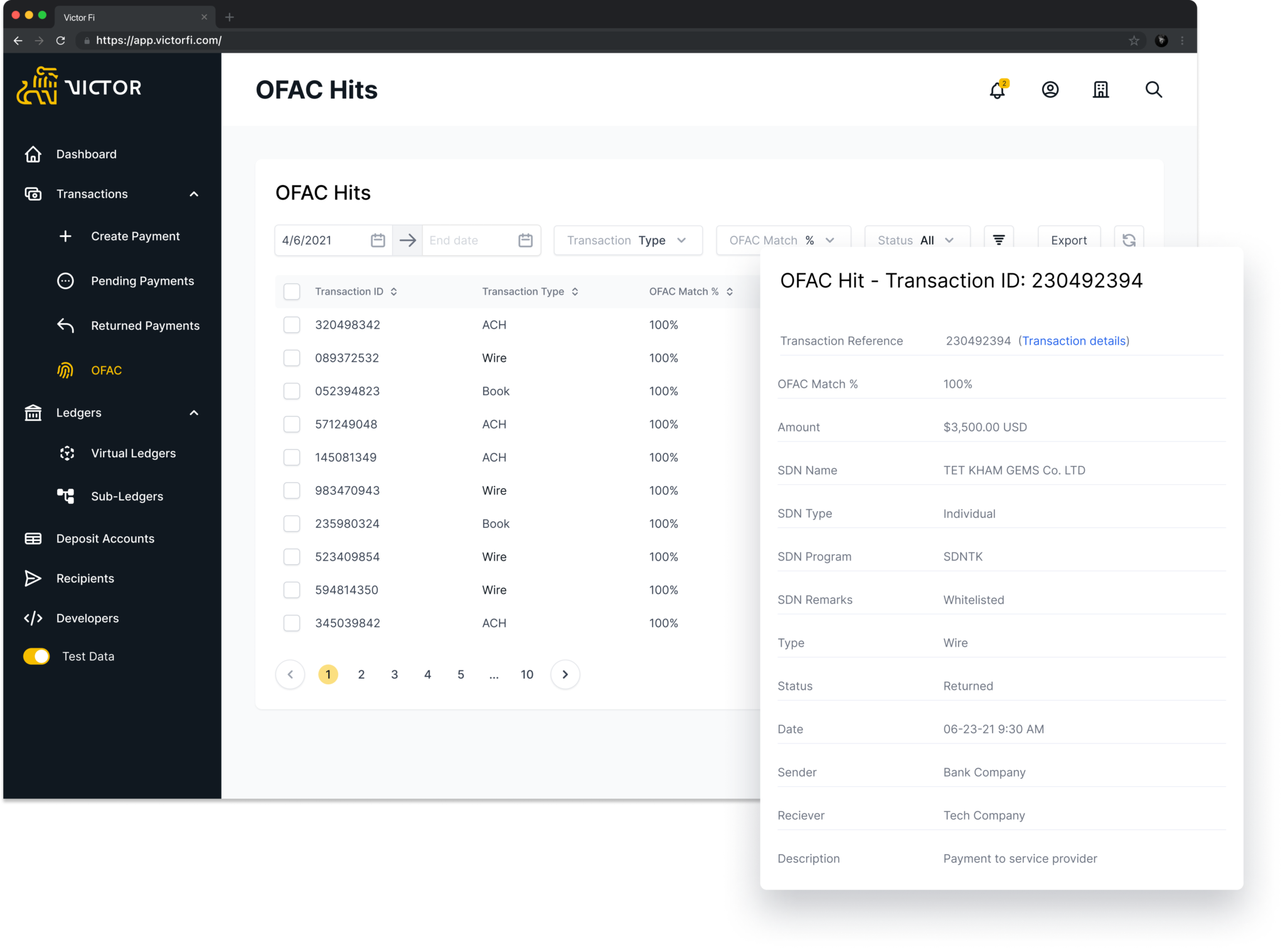

All transactions processed on Victor APIs will be automatically checked against the OFAC’s SDN list, other sanctions lists, and targeted countries lists. If there is an OFAC hit or match on a transaction, the details of the match will be viewable on the Victor Platform from the OFAC hits page, allowing businesses to compare the name of the recipient or customer to the name on the sanctions list and providing access to valuable information about what triggered the hit.

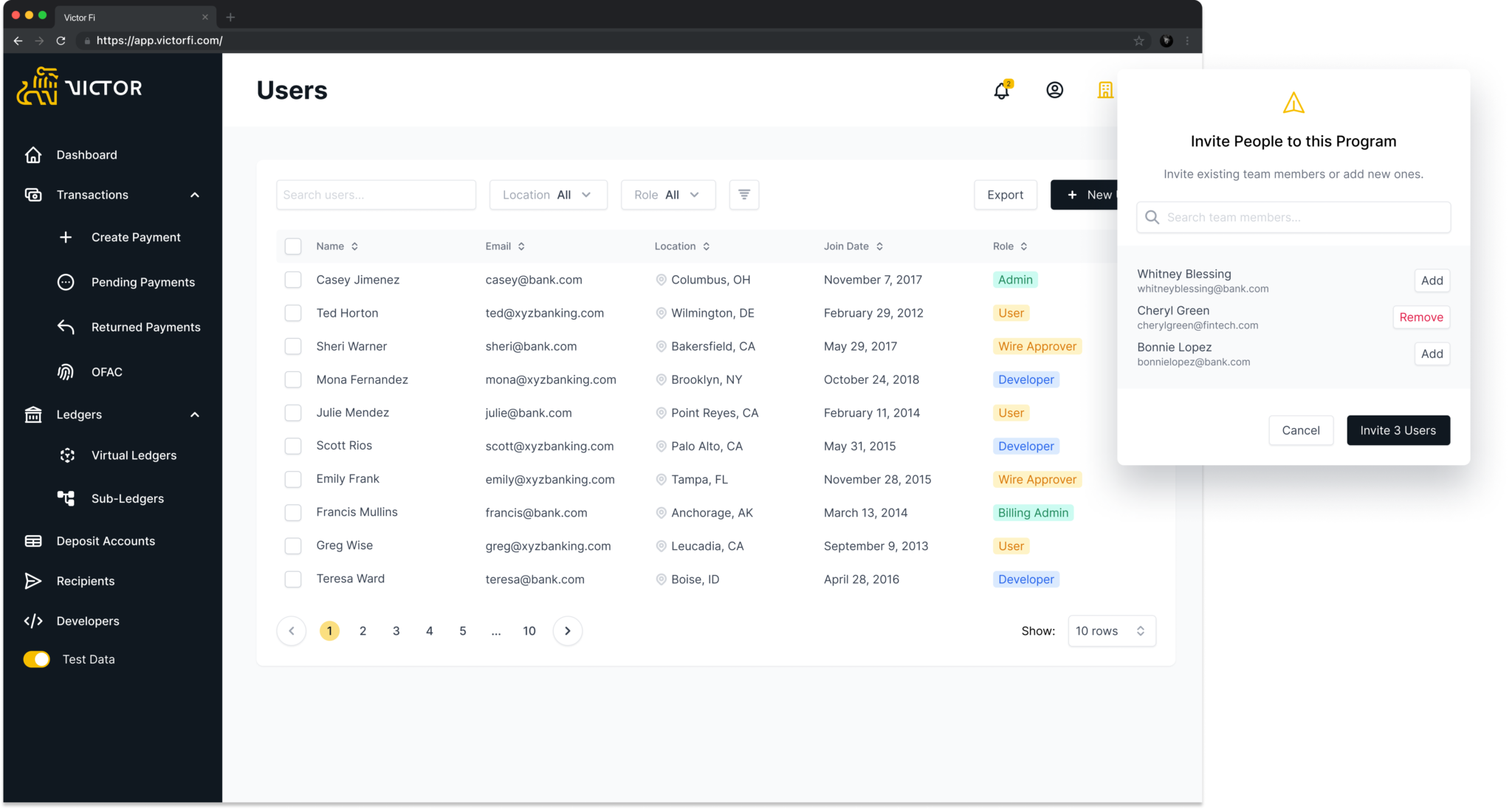

User Management

The new user management feature will allow organization administrators to invite new users to the Platform. Invitations can be created to invite a single user, or you can select to invite multiple users at a time. User management provides organizations with the ability to view and manage a list of all users. The User Management feature also includes support for role management, so that program administrators can assign users a specific role within the Victor Platform and adjust role assignment as needed.

COMING SOON

In the next release of the Victor Platform, we will be introducing support for Bulk Payments (also called mass or batch payments). The Bulk Payments functionality on Victor enables businesses to create and send multiple payments simultaneously. Create Bulk Payments with a few clicks or upload a spreadsheet containing all the payout details for even faster bulk payment creation. Transaction history logs allow senders to keep track of their complete payment history and payment data can be easily exported from the Victor Platform.

Whether creating a payment from multiple originating accounts to send to a single recipient, one account to send to many recipients, or many originating accounts to many recipient accounts, with Bulk Payments it’s never been easier or faster to send money to multiple people.

About Victor Technologies

Victor Technologies, Inc. is a wholly-owned subsidiary of MVB Bank, Inc. Victor is a banking technology platform that empowers new innovations in Bank-Fintech partnerships. Victor helps scale these partnerships by enabling them to maintain compliance at scale. Whether you are in Crypto, Gaming, or Payments, we can power your solution. Learn more at victorfi.com or connect on LinkedIn and Twitter.